- Bitcoin price has rallied fast

- Coronavirus continues to have money leaving

- $10,000 just above

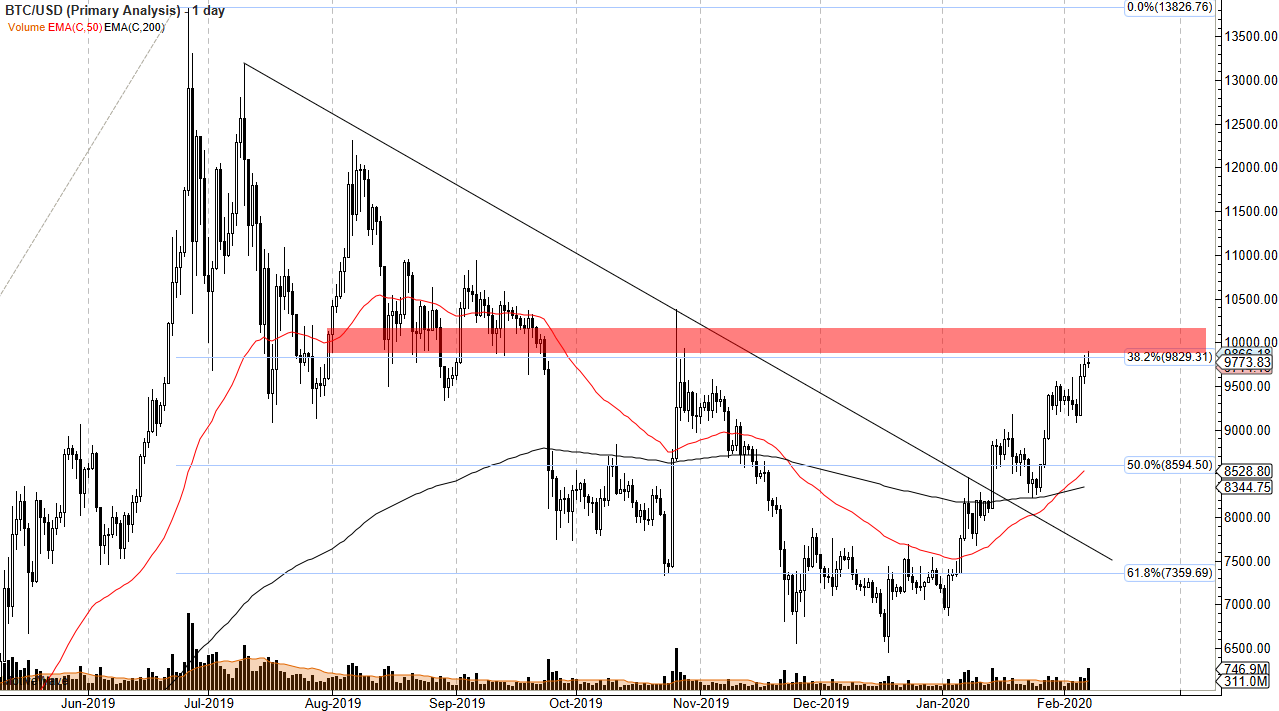

The Bitcoin markets have been rallying significantly over the last several weeks, as it had a major breakout from a downtrend, and has rocketed towards the $10,000 level. Ultimately, Bitcoin has shown strength that it hasn’t seen in well over a year or so.

Coronavirus and money flowing out of China

The coronavirus has been a major influence into monetary flow when it comes to China. In the past, Chinese nationals have used Bitcoin to get money out of the country when there are monetary restrictions. The Chinese Communist Party will quite often limit the ability for citizens to move money across borders, and this is why Bitcoin is such an interesting indicator when it comes to China.

The most recent uptrend had been highly influenced by Chinese nationals, and it is worth noticing that the move in Bitcoin has coincided with the beginning of the virus catching on in the city of Wuhan and the mainland itself.

This is something that’s very interesting for global traders, because this has happened a couple of times now, so Bitcoin can be a sign of economic stress in China. That being said, these rallies tend to serve more of a functional purpose than anything else. Moving money across international borders is probably the most impressive case use for Bitcoin and perhaps the most successful one. Furthermore, it is being adopted in some of the smaller economies around the world, but it is difficult to imagine it being adopted in larger places like the United States. Meanwhile it remains a good way to move money across borders and around the prying eyes of governments at times.

Technical analysis for Bitcoin

BTC/USD yearly chart

The technical analysis for Bitcoin is rather promising, but it is starting to show a bit of resistance here at the $10,000 level. This makes sense, as the $10,000 level is a large, round, psychologically significant figure. The candlestick for the Friday session is starting to show signs of exhaustion, as the potential for a shooting star presents itself. It makes sense that the market could pull back from this level, but there is obviously a lot of buying pressure underneath. Furthermore, the 50-day EMA has broken above the 200-day EMA, forming the so-called “golden cross.”

If the market does break above the $10,000 level, the market is free to go looking towards the $10,500 level. However, if the market were to break down below the lows from the Wednesday session, that would be a very negative sign and could send the Bitcoin markets down towards the $8600 level.

Ultimately, the market is still relatively bullish, but needs a pullback in order to build the necessary momentum to break above the psychologically significant figure which should make quite sense. At this point, a little bit of softness might be exactly what the Bitcoin market needs in order to build up the necessary pressure to go higher.