- Massive amount of negativity in the markets

- Gold a safe-haven asset

- Coronavirus, trade war, and loose monetary policy

The one thing that the markets have seen a constant diet of has been concerns. There are plenty of reasons why traders have been afraid of the global markets. Therefore, as the gold markets are considered a safe haven at times, gold has enjoyed quite some inflow.

The situation for gold is a “perfect storm” as the factors that typically push this market higher have all been in alignment lately.

A host of issues

There is a whole host of issues (as gold traders can tell you) as to why gold should continue to rally. The first and most obvious reason is that it’s in a technical uptrend to begin with.

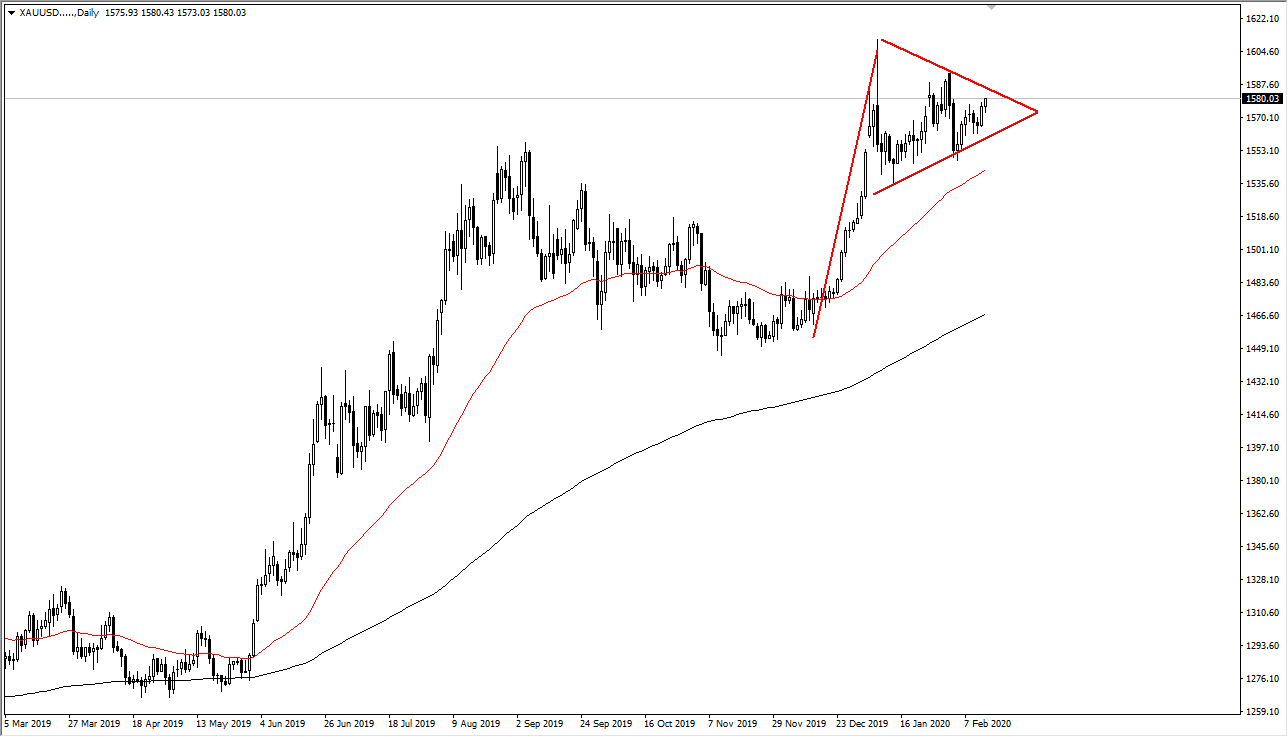

Looking at the price, it is coming close to the $1585 level, which is a potential downtrend line for a pennant. Ultimately, this is a market that has been rising for some time, as the reasons for a strengthening gold market seem to be continuous.

The investor can protect their portfolio against the massive amount of volatility in loss in riskier assets

To begin with, central banks around the world keep a very loose monetary policy, devaluing fiat currencies. That makes gold rise in value against currencies. The gold market against the US dollar has been rising as well, showing extraordinarily bullish pressure, as the US dollar itself has been strong. The fact that gold can rally against it tells you just how strong it truly is.

The coronavirus has caused a lot of issues as well, which would be the latest reason that gold has rallied due to the concerns over a global slowdown. By owning gold, the idea is that the investor can protect their portfolio against the massive amount of volatility in loss in riskier assets. That being said, gold has reacted to the virus quite stringently.

Furthermore, gold had been in a rally due to the US/China trade war, as the concerns about global markets slowing down were a major issue.

In other words, there has been a constant barrage of negative headlines that continues to push money into this market.

Technical analysis for gold/USD

Gold vs. US dollar chart

The technical analysis still favors the gold market to go higher. The market is in a bullish pennant, with the 50-day EMA underneath offering some support.

The market could go as high as $1750, as it is the measured move from the pole of the technical pattern. This should continue to bring technical traders in as well.

As long as gold can stay above the red 50-day moving average on the chart, it’s very likely that there will be more upward momentum. That should send this market looking towards that longer-term target.

Even if some of the other issues abate, the central banks around the world and their loose monetary policy will continue to drive gold higher.