- Bitcoin breaks higher with coronavirus

- It has a history of breaking higher with Chinese issues

- Cryptocurrency clears $10,000

While there is a certain amount of debate as to whether or not Bitcoin is in a huge new uptrend for the longer-term, or if it’s a short-term reaction, the reality is that Bitcoin has been moving right along with the coronavirus outbreak. In fact, Bitcoin has become a leading indicator for China-related issues.

In the past, Bitcoin has been used to get money out of mainland China quickly, ahead of issues. That is typically followed by monetary restrictions as the Chinese Communist Party limits monetary outflows from the country.

That being said, you can see a clear correlation between the beginning of the coronavirus and Bitcoin itself. That represents the Chinese trying to get money out of the country. While there are obviously other buyers, the reality is that China is by far one of the most important user bases of Bitcoin in the world, as it is a way to navigate around tight communist controls.

The last time there was a massive flow of money out of China, Bitcoin rallied significantly only to give those gains back up. This could be what’s happening next, but for the meantime, it should be noted that there have been some very significant barriers breached by Bitcoin traders, which should continue to be influential in this marketplace. With that, the technical analysis becomes more important than ever.

Technical analysis showing BTC/USD

Bitcoin six-monthly chart

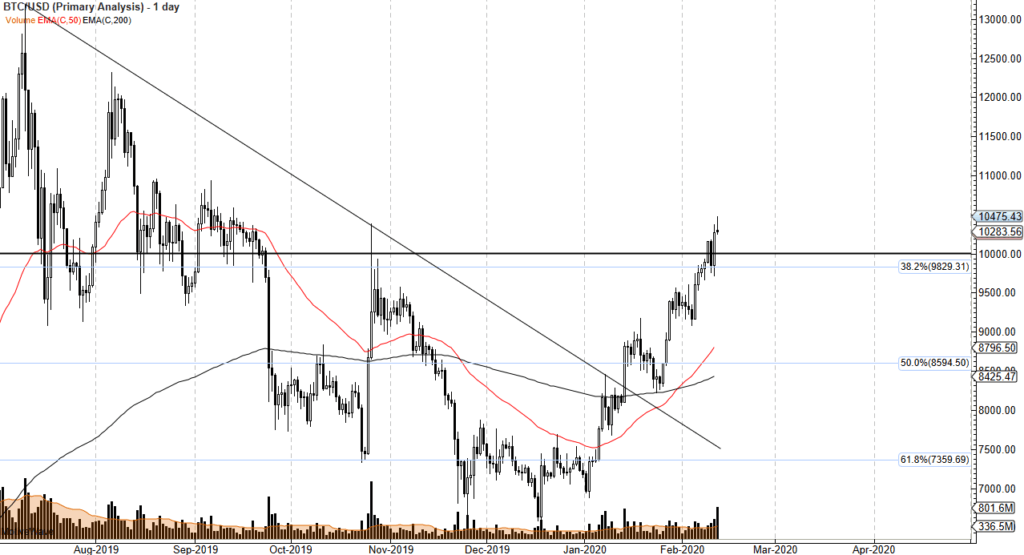

The technical analysis for the market has been very bullish as of late, but it does look as if we might be getting a little overextended. Beyond that, volume has picked up during the trading session on Wednesday, which suggests that perhaps something is happening under the surface.

As the market is forming a shooting star, it does in fact suggest that perhaps a lot of profit-taking may be going on, and perhaps even fresh, new sellers. All things being equal, though, it looks as if the market is going to go back and forth, and it’s not necessarily a sign that it’s going to suddenly fall apart.

Ultimately, if the market was to break above the shooting star-shaped candle for the Wednesday session, that would be very bullish and should send Bitcoin looking towards $11,000. As things stand right now, that is the best-case scenario, perhaps after a short-term pullback.

Furthermore, the 50-day EMA has cleared above the 200-day EMA forming the so-called “golden cross,” which is a very bullish sign. Bitcoin still looks relatively strong and the impulsive candlestick from the previous session does foretell some good things.

However, the market is at a technically important level, and the whole world knows it. Because of this, there is going to be a bit of trepidation and possibly backfilling needed in order to produce any type of continuation move.