People wait on a long line to receive a food bank donation at the Barclays Center on May 15, 2020 in the Brooklyn borough in New York City. The event was organized by Food Bank for New York City and included dairy and meat items.

Millions more Americans lost their jobs in May, on top of the 20.5 million in April, and economists believe the unemployment rate rose to near 20%, the likely peak in the Covid-19 recession.

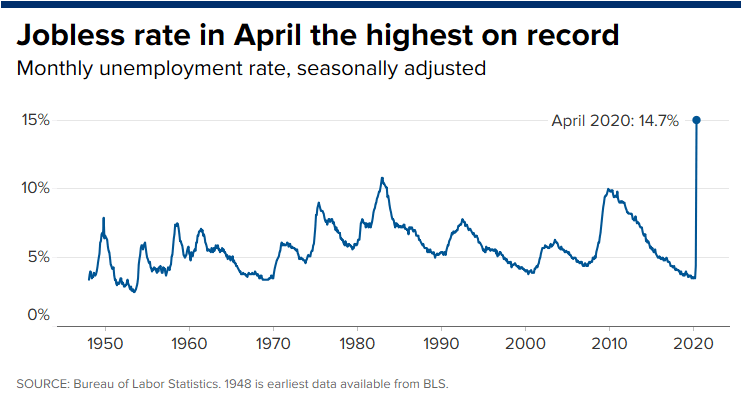

Economists are forecasting about 8.3 million jobs were lost, and that the unemployment rate rose to 19.5%, according to Dow Jones. That compares to an unemployment rate of 14.7% in April. The employment report, expected Friday morning, follows Thursday’s report that nearly 1.9 million people filed for unemployment claims last week.

“May was this transition month. The layoffs were very high, but in the latter part of the month, rehiring started. This employment report is probably the peak of the disaster in the labor market,” said Ethan Harris, head of global economics at Bank of America.

Bank of America economists expect that 8 million jobs were lost in May. Harris said there is a bigger chance of a surprise in the May employment data than there was in April because of the cross currents in May with the reopenings, and also continued layoffs.

“By all metrics, whether it’s the unemployment rate, which we have peaking at 19% or the layoffs, this should be the last negative (monthly jobs report)… The next number will be positive. You’re going to have millions of jobs added in coming months,” Harris said. “Our assumption is that only about half of the jobs that were lost come back over the course of the next three to six months.” He said the unemployment rate should get to 13% by September and 11% by yearend.

There is some speculation that the number may not be as dire as forecast because ADP’s private payrolls report Wednesday showed a decline of just 2.76 million jobs, about 6 million less than economists expected. But the ADP report does not often line up with the government report, so economists are still forecasting millions more positions were lost than in the ADP report.

“We’re still looking for a 7 million decline. We still think we lost a tremendous amount of jobs in May, and the unemployment rate goes up to 17.5%,” said Michael Gapen, Barclays chief U.S. economist. “We still should have a net gain in employment beginning in June…That’s the good news. The likely bad news is the recovery is likely to be slow and halting.”

Great Depression levels

Scott Anderson, chief economist at Bank of the West, said he is watching the report to see if jobs in manufacturing and construction accelerated or decelerated, and whether layoffs extended to state and local government, or any new sectors, like financial services.

“This May number is going to be bad,” he said. “We’re looking at an unemployment rate approaching Great Depression levels. We’re expecting 10 million jobs were lost…We think the unemployment rate will hit 20.5%. When you look at the claims reports, it’s pretty horrific. We’re still looking at elevated unemployment claims.”

The employment report could help provide some insight into how the recovery will play out, but it also depends very much on the course of the virus and whether there is another outbreak, he said.

“It seems like folks are beginning to venture out. We’ll see if the gains continue. The openings are happening a little faster than expected,” Anderson said. “We do worry about a second wave. We’re not out of the woods. (The) third quarter looks a lot stronger than we thought a month ago.” He noted the fourth quarter could slow down again, if the virus returns, and economists say there could be another round of layoffs.

Economists had expected a much larger unemployment rate for April, and now many expect it to move up to around 20%.

Bank of America economists explained, in a note, that many workers, impacted by Covid-19 shutdowns, just dropped out of the labor force or showed up in a category of workers that remained employed but were not at work. They believe if the number was adjusted, the unemployment rate was probably 20% in April.

In the April jobs report, the government’s survey of unemployed workers found that 78% believed their layoffs to be temporary. That’s a number that will be watched closely since as time has gone on, economist said many of those workers may not be brought back because their companies won’t need as many employees.

Restaurants, for instance will need to expand the space between customers, and that could reduce their operations substantially. Airlines are seeing interest from travelers, but they are not planning anything near the capacity they had prior to March.