An unusual phenomenon is occurring during the sharpest downturn in U.S. history: Americans have money in their pockets.

Economic and banking data are revealing that Americans are earning and saving money during the coronavirus crisis, thanks to unprecedented stimulus from the federal government. The rescue funds could be responsible for facilitating the quickest recession in history.

Consumer spending and savings are up from last year on a per-client basis at digital banking company Chime, which has more than 6.5 million accounts. Chime is the largest of a new breed of branchless U.S. banks that offer no-fee accounts, free overdrafts and early direct deposits on paychecks.

“We’ve seen people sort of move and go get other jobs. We’ve seen people get access to unemployment insurance, to stimulus payments, and all of this collectively has resulted in higher spend and higher savings actually, which is also a little bit surprising,” Chime CEO Chris Britt said at a Piper Sandler FinTech conference Wednesday.

In the largest piece of stimulus legislation in our nation’s history, the U.S. government passed, in rapid fashion, the CARES Act in response to the global pandemic and record unemployment. The U.S. Treasury sent $1,200 to individuals with annual income below $75,000 and $2,400 to married couples filing taxes jointly who earn under $150,000.

The Treasury said Wednesday it made 159 million payments worth more than $267 billion to struggling Americans in just two months. The rescue funds were sent to all eligible Americans known to the IRS.

“These payments are an integral part of our commitment to providing much-needed relief to the American people during this unprecedented time,” Treasury Secretary Steven Mnuchin said.

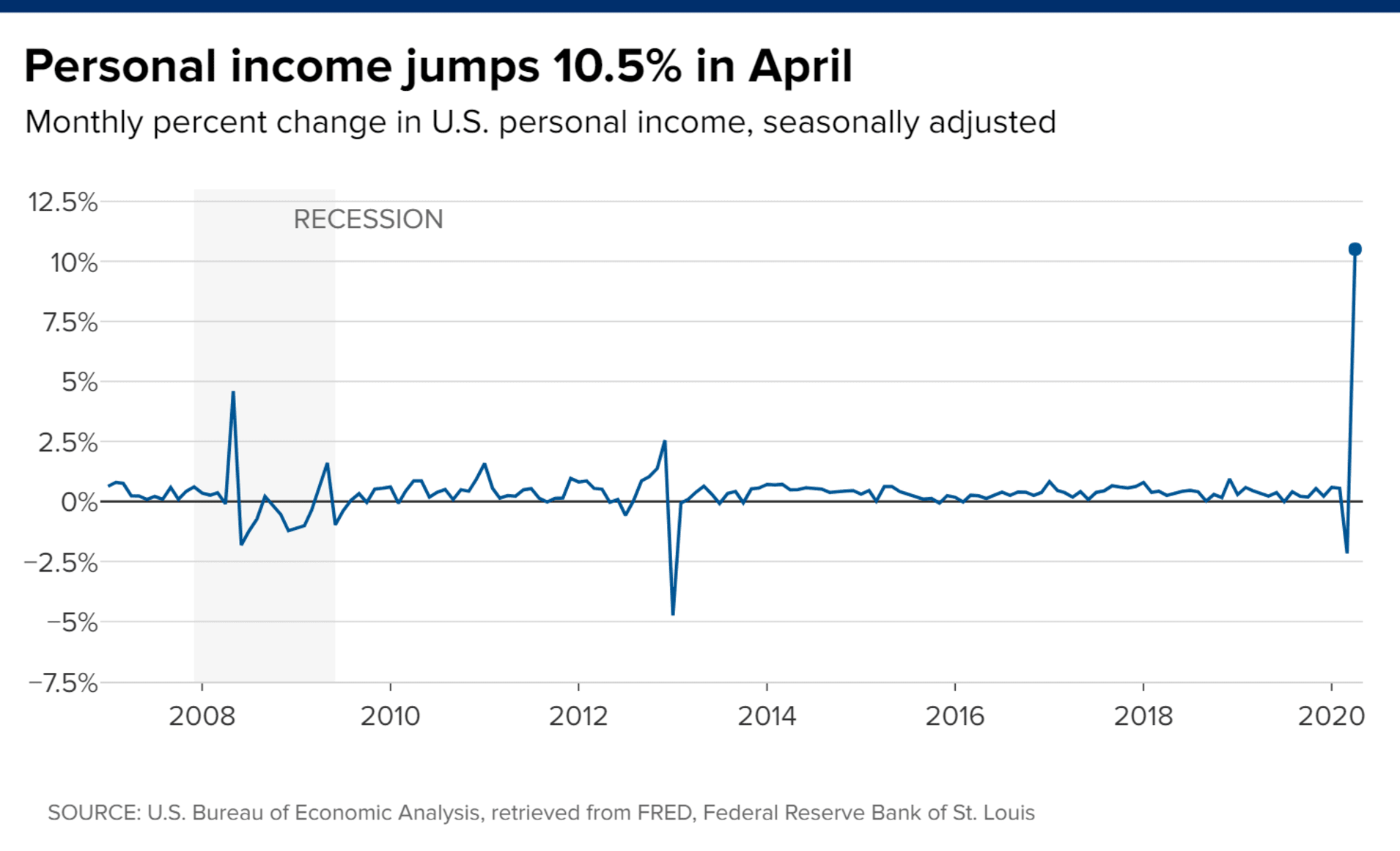

Personal income jumps 10.5% in April

Amid a backdrop of 42 million Americans filing for unemployment benefits due to the Covid-19 shutdown, personal income increased 10.5% in April, the Bureau of Economic Analysis said last week. This is unique against the backdrop of past recessions where incomes fell overall.

When the U.S. economy was embroiled in the Great Recession, personal incomes — the money that people get from wages and salaries, Social Security and other government benefits — declined on the whole.

But as stimulus checks were deployed this spring in rapid response to the coronavirus pandemic, American incomes actually rose. Oxford Economics estimates social benefits lifted income by roughly $3 for every dollar lost in compensation.

Disposable income also leaped 12.9% in April. Personal savings rose to a historic 33% from April to May as Americans stockpiled cash during the government mandated shutdowns.

“Although unemployment is really troubling, the consumer balance sheet has been pretty strong. With the government funding unemployment the way they are, you have basically an entire swath of the population that is making money and not spending it,” Timothy Lesko, portfolio manager at Granite Investment Advisors, told CNBC.

“Go to the next tier of income and you have a middle class who kept their jobs and aren’t spending. The pent-up demand is pretty significant, it’s just a matter of when they feel comfortable spending it and as each day goes on, we seem to be getting better and better data about increases in travel and increases in spending.”

Economy vs. stocks

Congress approved the payments to see the economy through what will be its worst downturn since the Great Depression. Quiet remarkably, U.S. equities have almost fully recovered from the market rout, already looking through to a recovery in economic activity.

The three major averages are up more than 40% from their lows in March and the technology-heavy Nasdaq Composite is less than 1.5% from its record high. The S&P 500 is trading above 3,100 for the first time since March and the Dow Jones Industrial Average is trading above 26,000.

Historic and unwavering monetary and fiscal stimulus programs are helping to keep stocks skyward as investors shrug off nationwide protests over the death of George Floyd at the hands of police and tensions between the U.S. and China.

A sharp rise in consumer incomes and savings is contributing to the market “looking through,” said Lesko.

“As the economy opens, stock prices are starting to reflect what we’re going to see a year from now, not what we saw during the depths of this in April and May,” added Lesko.